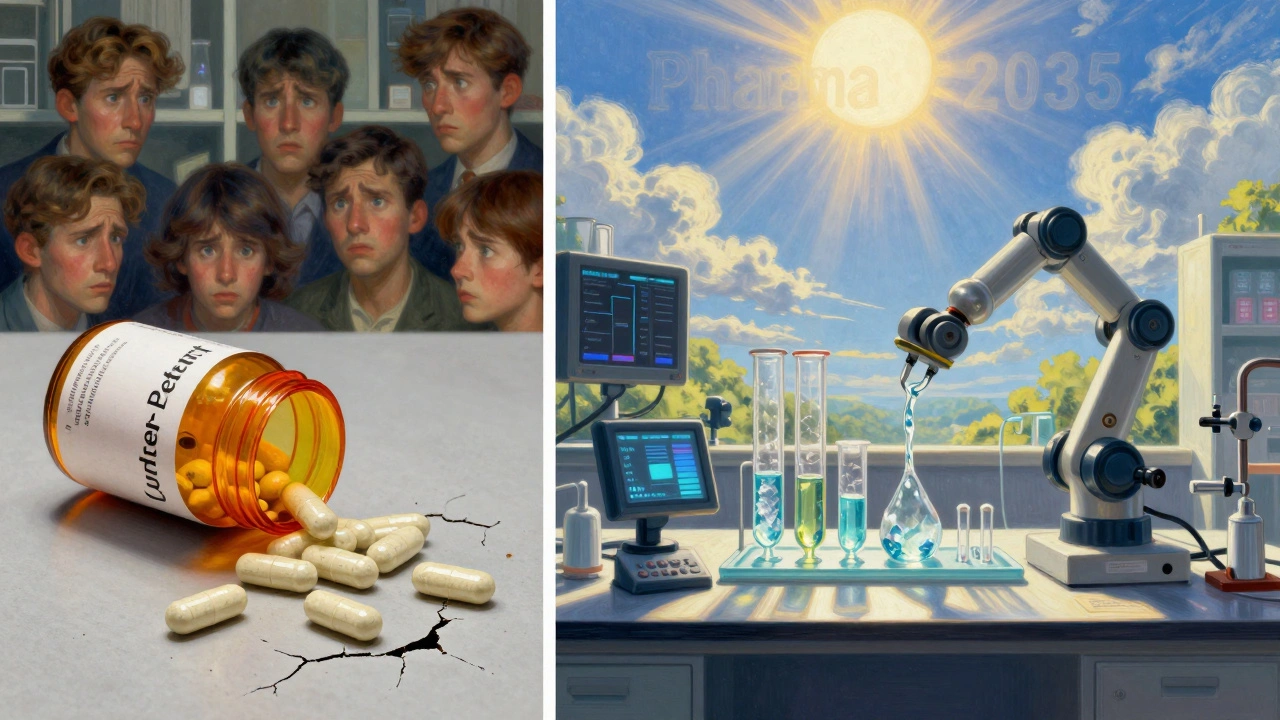

When you take a generic pill for high blood pressure, antibiotics, or diabetes, there’s a better than 70% chance the active ingredient inside came from China. That’s not speculation-it’s fact. As of 2023, Chinese manufacturers supplied 80% of the world’s active pharmaceutical ingredients (APIs), the core chemical components that make generic drugs work. But behind that staggering number lies a deeper, more troubling story: how quality, oversight, and supply chain risk are shaping the future of medicine for millions.

Why China Dominates Global API Production

China didn’t become the world’s API powerhouse by accident. After joining the World Trade Organization in 2001, the government poured billions into building chemical manufacturing infrastructure. State-backed policies, relaxed environmental rules, and cheap labor created the perfect storm for mass production. Today, companies like Sinopharm and Shijiazhuang Pharma Group churn out 500 to 2,000 metric tons of APIs per year-far more than any Western plant can match. The cost difference is brutal. A kilogram of generic API made in China costs $50-$150. The same thing made in the U.S. or Europe? $200-$400. For drugmakers trying to keep prices low, that’s irresistible. But low cost doesn’t mean low risk.The Quality Gap: What the FDA Keeps Finding

The U.S. Food and Drug Administration inspects over 1,800 foreign drug facilities each year. Nearly 30% of those are in China. And what they find isn’t encouraging. In inspections from 2022 to 2023, 78% of Chinese API plants had issues with laboratory controls. That means testing wasn’t reliable-results were either inaccurate or missing. Sixty-five percent failed to properly validate their manufacturing processes. And 52% had data integrity problems: records were altered, deleted, or never created in the first place. A 2023 FDA study found that 12.7% of Chinese-sourced API samples failed purity tests. Compare that to 2.3% from Europe and just 1.8% from the U.S. That’s not a small difference-it’s a massive gap. One real-world example: In 2023, Zydus Pharmaceuticals recalled 1.2 million bottles of blood pressure medication because the API from Huahai Pharmaceutical in China was under-potent. Patients weren’t getting enough medicine. That’s not a manufacturing error-it’s a safety failure.Outdated Tech in a High-Stakes Industry

Most Western drugmakers have moved to continuous manufacturing-where chemicals flow through pipes in a steady, controlled stream. It’s more precise, less prone to contamination, and easier to monitor. In China? Sixty-five percent of API production still uses old-school batch processing. Think giant vats, manual transfers, and human judgment at every step. It’s cheaper, but it’s also far more likely to produce inconsistent batches. And while the U.S. and EU have been investing in automation and AI-driven quality control, China’s adoption of these technologies remains low. The government says it wants to change that. In 2024, China’s NMPA announced a new rule: by 2026, 30% of high-volume APIs must be made using continuous manufacturing. But right now, that’s just a target-not reality.

Who’s Really in Control? The Supply Chain Trap

Here’s the twist: China doesn’t make most finished pills. It makes the chemicals inside them. India, the world’s largest exporter of generic drugs, gets 65% of its APIs from China. So when a patient in London takes a generic antibiotic, it’s likely made in India-but the key ingredient came from a factory in Zhejiang Province. That creates a dangerous dependency. If China cuts off exports-whether due to trade tensions, natural disaster, or political conflict-hundreds of millions of people could face drug shortages. Dr. Andrew von Eschenbach, former FDA commissioner, called this a national security risk. He’s right. Ninety percent of essential medicines rely on Chinese-sourced key starting materials. And it’s not just about politics. In 2022, a lockdown in Shanghai disrupted chemical shipments for weeks. Generic drugmakers in the U.S. and Europe scrambled. Some ran out of stock. Patients went without.China’s Efforts to Fix the Problem-And Why They’re Falling Short

China knows the reputation problem. In 2016, it launched the Generic Consistency Evaluation (GCE) program. The goal? Make sure Chinese generics work just like the original branded drugs. Sounds good, right? But as of 2024, only 35% of approved generic drugs have completed the evaluation. Thousands of manufacturers still operate without meeting basic bioequivalence standards. And while the government claims it shut down 80% of non-compliant plants since 2015, the number of generic drugmakers has only dropped from 7,000 to 2,500. That’s still a massive, poorly regulated industry. The NMPA also introduced a faster approval pathway for domestic originator drugs-but not for generics. That means Chinese companies can get new patented drugs to market quicker, but the cheap, off-patent medicines? Still stuck in the slow lane.

Billy Schimmel

December 6, 2025 AT 16:28So we’re paying less for pills but risking our lives? Cool. Guess I’ll just keep buying my $3 metformin from the corner store while my grandma prays her blood pressure doesn’t spike. Classic American efficiency.

Ibrahim Yakubu

December 8, 2025 AT 07:36China doesn’t make bad drugs-they make drugs that work for the masses. You think your $200 insulin is safer? It’s just more expensive. Nigeria’s got no choice but to take what’s cheap and available. Your fear-mongering won’t stop the flow of medicine-it’ll just make it cost more. Wake up.

Shayne Smith

December 9, 2025 AT 02:49I took a Chinese generic for my anxiety last year. Worked fine. My pharmacist didn’t even blink. Maybe the system’s broken, but it’s not collapsing. Chill out.

Andrew Frazier

December 9, 2025 AT 08:28LOL the US is so weak. We used to make everything. Now we cry because we can’t afford to pay Chinese workers $2/hour to make our meds. Build factories. Stop whining. Also, India’s just China’s middleman anyway. Wake up sheeple.

Karen Mitchell

December 11, 2025 AT 04:09It is, without question, a profound dereliction of ethical responsibility to outsource the foundational components of human health to a regime that systematically falsifies data, disregards environmental standards, and treats its labor force as expendable. This is not capitalism. This is moral bankruptcy.

Geraldine Trainer-Cooper

December 11, 2025 AT 16:30we’re all just molecules floating in a system that doesn’t care if we live or die as long as the profit margin stays above 12%

pharma is just another religion and the priests are in Shanghai

Nava Jothy

December 13, 2025 AT 15:35China is stealing our medicine AND our dignity 😭

How dare they make it cheaper?! We paid for the R&D!!

Meanwhile, my cousin in Delhi is alive because of these pills and you’re here crying about ‘data integrity’??

First world problems on steroids 💔

olive ashley

December 15, 2025 AT 15:33Did you know the FDA gets paid by the drug companies they inspect? And China’s factories? They pay off inspectors with red envelopes and free tea. This isn’t a supply chain issue-it’s a global conspiracy. The WHO, Big Pharma, and the Chinese government are in cahoots. They want you dependent. They want you docile. They want you taking pills made in secret labs while you scroll TikTok. Wake up. The pills are tracking you.

Mansi Bansal

December 17, 2025 AT 01:00One cannot help but observe, with a heavy heart and a meticulously documented spreadsheet, that the commodification of human physiological integrity has reached its zenith in the form of API outsourcing to jurisdictions with historically lax regulatory enforcement. The moral calculus here is not merely economic-it is ontological.

pallavi khushwani

December 17, 2025 AT 15:05maybe the real question isn’t where the medicine comes from but why we let price decide who lives and who doesn’t. if we all just paid a little more, maybe we could fix the system instead of blaming the factory.

just a thought.

Dan Cole

December 17, 2025 AT 19:20China’s entire pharmaceutical strategy is a textbook case of state-capitalist predatory pricing. They’re not competing-they’re weaponizing cost. The U.S. doesn’t have a drug shortage crisis. We have a leadership crisis. We let corporations outsource ethics. And now we’re surprised when the pills don’t work? Pathetic.

Katie O'Connell

December 18, 2025 AT 15:32It is astonishing to me that any rational person would accept the notion that pharmaceutical quality can be maintained under conditions of systemic regulatory arbitrage. The FDA’s inspection regime is a farce. The entire global supply chain is a house of cards built on the assumption that profit motive supersedes human life. This is not a market failure-it is a civilizational failure.

Clare Fox

December 18, 2025 AT 17:51we’ve been taught to think cheap = good

but what if cheap just means someone else paid the price?

and we’re not even paying it with money

Akash Takyar

December 19, 2025 AT 16:45While the challenges are significant, I remain hopeful that collaborative international frameworks, coupled with strategic investment in emerging manufacturing hubs, can gradually rebalance the global pharmaceutical ecosystem. Patience, diligence, and ethical stewardship will ultimately prevail.

Arjun Deva

December 20, 2025 AT 19:33They’re putting tracking chips in the pills. That’s why the FDA keeps approving them. They’re collecting your biometrics through your blood pressure meds. The 80% stat? It’s not about production-it’s about control. They’ve already got your data. You’re just a node in their network.