Every time you walk into a doctor’s office, hospital, or clinic, you’re trusting that your health information and finances are safe. But until recently, many patients had no real control over how their medical bills were handled-or even how they gave consent for treatment. In 2024, New York State changed that. Three new laws went into effect on October 20, 2024, and they’re the strongest patient financial protections in the country. These aren’t just bureaucratic updates. They’re direct responses to a crisis: over 100 million Americans carry $195 billion in medical debt, and millions more have been hit with surprise bills, hidden fees, or pressured into credit agreements they didn’t fully understand.

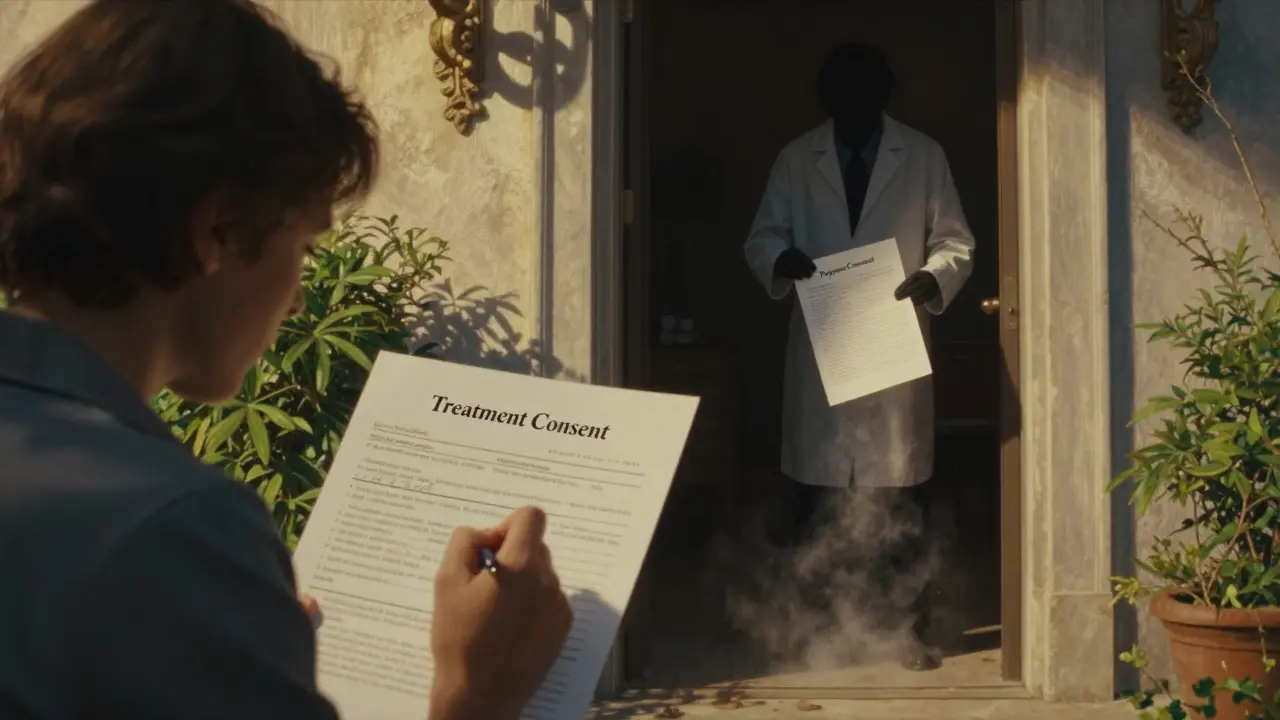

Separating Consent: Treatment vs. Payment

For years, hospitals and clinics used one form to get patients to sign away both their consent for treatment and their permission to bill them. You’d fill out paperwork at check-in, sign at the bottom, and assume it was all part of the same process. That’s over. New York’s Public Health Law Section 18-c now requires providers to get two separate consents: one for medical care, another for payment. You can’t sign one form that covers both anymore. The law was meant to stop providers from burying financial terms in routine intake paperwork. Violations cost up to $2,000 per incident.

But here’s the twist: as of August 2025, enforcement of Section 18-c was suspended. That doesn’t mean the law is gone-it’s on hold. Providers are still expected to follow it, but state regulators have paused penalties while they review implementation. This creates confusion. Some clinics still use old forms. Others have already switched. Patients should still ask: "Are you asking me to consent to treatment separately from how I’ll pay?" If the answer is no, you’re being asked to agree to outdated practices.

No More Filling Out Your Credit Application

Have you ever been handed a CareCredit® application while waiting for your appointment? Maybe a staff member said, "We can help you apply now," and started filling in your income or employment details? That’s illegal under New York’s General Business Law Section 349-g. Providers can’t complete any part of a medical financing application-not even a single field. They can answer questions. They can hand you the form. They can even say, "This option might help you avoid a large upfront payment." But they can’t touch the pen. The application must be filled out entirely by you.

This law targets predatory practices where clinics pushed patients into high-interest medical loans without fully explaining the terms. A 2023 study found that over 40% of patients who used CareCredit® didn’t realize the interest rate would kick in if they didn’t pay off the balance within 12 months. Now, if a provider helps you fill out the form-even by accident-they could be fined up to $5,000 per violation. The New York State Department of Health made it clear: if you didn’t complete every box yourself, the application is invalid.

Don’t Let Them Keep Your Credit Card on File

Emergency rooms used to ask for your credit card before treating you-even for life-threatening conditions. Some even required preauthorization, meaning they’d charge your card upfront just to stabilize you. That’s now banned under General Business Law Section 519-a. Providers can’t require your credit card information before giving emergency or medically necessary care. They also can’t keep your card on file without your explicit, written permission.

But here’s what most people don’t know: there’s a big difference between paying with a regular credit card and using a healthcare-specific financing product like CareCredit®. If you use your Visa or Mastercard to pay a hospital bill, you lose access to federal and state protections. Medical debt from healthcare financing products can’t be reported to credit bureaus, can’t lead to wage garnishment, and can’t result in a lien on your home. But debt from a regular credit card? That’s treated like any other consumer debt. The law forces providers to tell you this every time you use a credit card for payment. You must receive a written notice that says: "Using a traditional credit card for medical services may remove your eligibility for medical debt protections."

How This Compares to Federal Law

Federal law already protects you from surprise bills from out-of-network providers thanks to the No Surprises Act, which started in January 2022. But that law doesn’t touch what happens inside your provider’s office. It doesn’t stop a clinic from asking for your credit card before surgery. It doesn’t require separate consent forms. It doesn’t ban staff from filling out your CareCredit® application.

New York’s laws go further. They close gaps federal law ignores. While the Consumer Financial Protection Bureau removed medical debt from credit reports in 2024, that only applies to debt from healthcare financing products-not credit cards. New York’s rules force providers to make that distinction clear. They also require recordkeeping, staff training, and updated forms. No other state has combined all three protections into one package.

What This Means for You as a Patient

If you’re in New York, here’s what you need to do:

- Ask for separate consent forms for treatment and payment. If they hand you one form, ask why.

- Never let anyone fill out a medical financing application for you-even if they say "it’ll be faster."

- If you’re asked for a credit card before emergency care, say no. You have the right to be treated first.

- Always read the notice about credit card payments. It’s required by law and tells you what protections you’re giving up.

- Keep copies of all consent forms and payment disclosures. If something goes wrong, you’ll need proof.

These laws don’t just protect you from surprise bills. They protect you from being manipulated into debt. Medical care should never come with hidden financial traps.

What This Means for Providers

For clinics, hospitals, and private practices, the changes are costly and complex. They’ve had to:

- Rewrite all intake forms to separate treatment and payment consent.

- Train every front-desk employee on what they can and can’t say about financing options.

- Install new systems to track which patients received credit card risk notices.

- Stop using pre-authorization for credit cards-even if they’ve done it for years.

Many small practices struggled to adapt. The state released final guidance just two days before the laws took effect. Some clinics didn’t have time to update systems. Others still use old forms because they don’t know the rules changed. Patients are now the frontline enforcers. If you notice a provider breaking the rules, you can file a complaint with the New York State Department of Health. It’s your right-and it’s how these laws stay alive.

The Bigger Picture

New York isn’t alone in this fight. The CFPB’s 2024 rule removing medical debt from credit reports, the No Surprises Act, and now these state laws show a clear trend: medical debt is being reclassified as a consumer rights issue, not just a financial one. Other states are watching. Experts predict at least five more states will pass similar laws by 2027. The goal isn’t to make healthcare cheaper-it’s to make it fairer.

When you walk into a doctor’s office, you shouldn’t have to choose between your health and your finances. These laws are the first real step toward making that true.

Do these New York laws apply to me if I live outside New York?

No, these laws only apply to healthcare providers operating in New York State. But if you receive care in New York-even if you’re from another state-you’re protected by them. For example, if you’re visiting New York and go to an ER, they can’t ask for your credit card before treating you. Federal protections like the No Surprises Act still apply nationwide, but the stricter rules on consent and financing only kick in within New York.

What happens if a provider violates these laws?

Violations carry serious penalties. For failing to get separate consent (Section 18-c), providers face $2,000 per incident. For filling out a patient’s medical financing application (Section 349-g), fines go up to $5,000 per violation. For requiring credit card preauthorization before emergency care (Section 519-a), penalties are also $5,000 per occurrence. Patients can file complaints with the New York State Department of Health, and investigations can lead to public fines, loss of licensure, or lawsuits.

Can I still use CareCredit® or similar financing?

Yes, you can still use CareCredit®, CareLending, or other healthcare-specific financing programs. But providers can no longer help you fill out the application. You must complete it yourself. The advantage of using these programs is that they come with stronger protections: medical debt from these sources can’t be reported to credit bureaus, can’t lead to wage garnishment, and can’t result in liens on your home. Traditional credit cards don’t offer those protections.

Why does it matter if I pay with a regular credit card vs. a medical financing product?

It matters a lot. Medical financing products like CareCredit® are legally treated as medical debt, not consumer debt. That means they’re protected under federal and state medical debt rules: no credit reporting, no wage garnishment, no liens on your home. But if you use a Visa, Mastercard, or Discover card to pay a hospital bill, that debt is treated like credit card debt for a vacation or groceries. That means it can be reported to credit bureaus, sent to collections, and even lead to wage garnishment. New York law forces providers to tell you this every time you use a credit card.

Are these laws permanent?

Two of the three laws (Sections 349-g and 519-a) are active and enforceable as of 2026. Section 18-c, which requires separate consent for treatment and payment, is currently suspended. That means penalties are paused, but the law hasn’t been repealed. Experts believe it will be reinstated in 2026 or 2027 after further review. Until then, providers are still expected to follow it. The state has not indicated it will remove the law entirely.