Infrastructure Investment

When talking about infrastructure investment, the allocation of capital to build, maintain, or upgrade physical assets like roads, bridges, utilities, and digital networks. Also known as capital infrastructure funding, it fuels the backbone of any economy and creates jobs across sectors. Infrastructure investment isn’t just about pouring concrete; it’s a strategic choice that shapes long‑term productivity, competitiveness, and quality of life.

Public‑private partnerships, collaborative contracts where government and private firms share risks, costs, and rewards have become a go‑to model for delivering large‑scale projects faster and more efficiently. By blending public oversight with private sector innovation, PPPs lower the upfront fiscal burden on taxpayers while still ensuring public‑interest safeguards. This hybrid approach often unlocks expertise that pure public agencies might lack, making complex undertakings like toll highways or hospitals feasible.

Project finance, a financing structure that relies on the cash flow of the project itself rather than the balance sheets of sponsors supplies the money needed when traditional loans fall short. Lenders evaluate the viability of the asset, its revenue streams, and contractual agreements before committing capital. This method pushes investors to focus on rigorous feasibility studies, risk mitigation, and clear revenue models, ultimately enhancing the project's financial discipline and transparency.

The ripple effect of well‑planned infrastructure investment reaches the broader economy. As new roads cut travel time, power grids deliver reliable energy, and broadband expands, businesses experience lower operating costs and higher output. This boost to productivity fuels economic growth, attracting further private capital and creating a virtuous cycle of development. Regions that lag in infrastructure often see slower job creation and reduced competitiveness, underscoring why strategic funding is a policy priority.

Effective risk management is the glue that holds these complex deals together. From construction delays and cost overruns to regulatory changes and environmental concerns, each risk can jeopardize returns. Investors employ tools like contingent‑value rights, performance bonds, and insurance to spread exposure. Regular monitoring, transparent reporting, and adaptive contracts allow parties to respond quickly, preserving project viability even when unexpected challenges arise.

Sustainable infrastructure, projects designed to minimize environmental impact, enhance resilience, and promote social equity is reshaping how we think about investment. Green bonds, climate‑aligned funds, and ESG criteria now guide capital flows toward low‑carbon bridges, energy‑efficient buildings, and climate‑resilient water systems. By integrating sustainability, investors not only meet regulatory expectations but also tap into a growing market of stakeholders demanding responsible outcomes.

Digital tools are accelerating the entire lifecycle of infrastructure projects. Data analytics, BIM (Building Information Modeling), and digital twins provide real‑time insights into construction progress, asset performance, and maintenance needs. These technologies improve decision‑making, reduce waste, and extend asset lifespans, ultimately delivering better returns for investors and users alike.

Below you’ll find a curated collection of articles that dig deeper into each of these topics— from financing tricks and partnership case studies to sustainability metrics and risk‑mitigation tactics. Whether you’re a seasoned investor, a policymaker, or just curious about how today’s projects shape tomorrow’s economy, this resource hub offers actionable insights you can put to work right away.

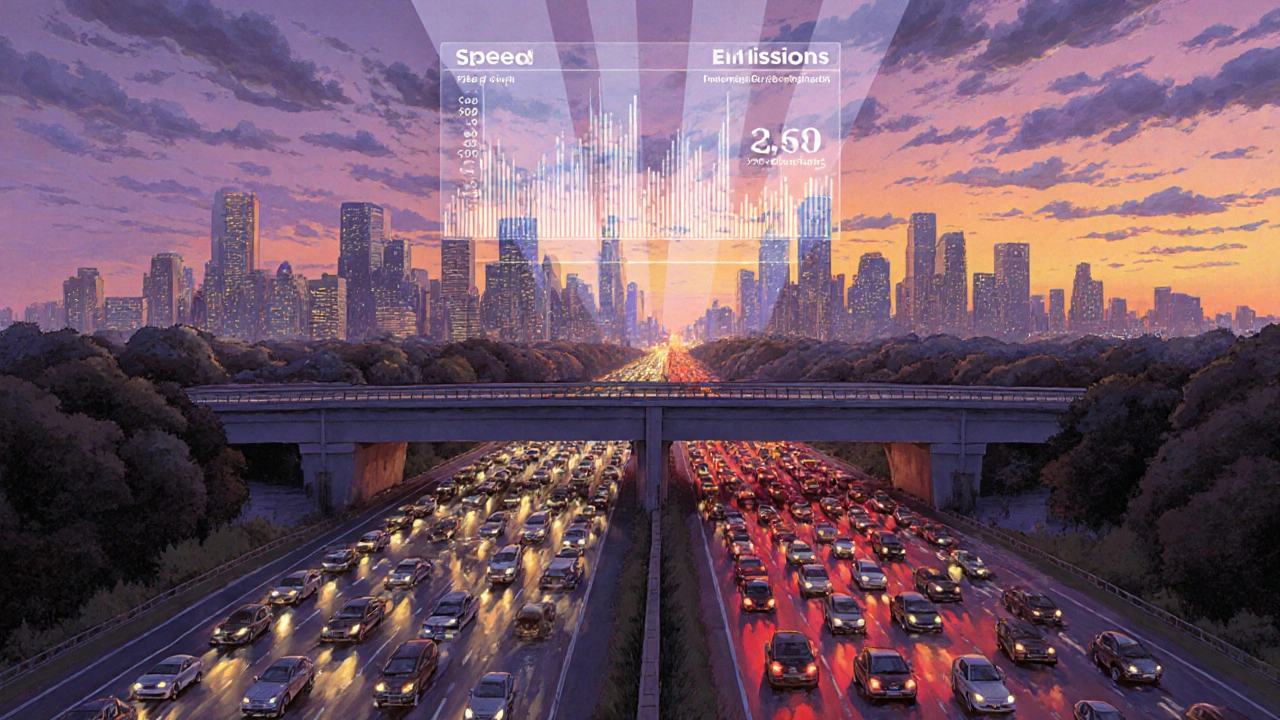

Infrastructure Investment: How It Can Ease Traffic Congestion

Explore how smart infrastructure spending-from road upgrades to congestion pricing-can cut traffic jams, boost productivity, and build resilient urban mobility.